V2 Retail Ltd: Financial Results Analysis (Q4 & FY25) and Long-Term Outlook

V2 Retail Ltd, a prominent player in India’s value retail sector, has released its financial results for the quarter and year ended March 31, 2025. The company’s latest performance reflects significant sales growth and a sharp improvement in profitability, signaling a strong recovery and renewed momentum. This analysis breaks down the key highlights from V2 Retail’s recent results, explores the drivers behind its turnaround, and evaluates the stock’s future prospects and suitability for long-term investors.

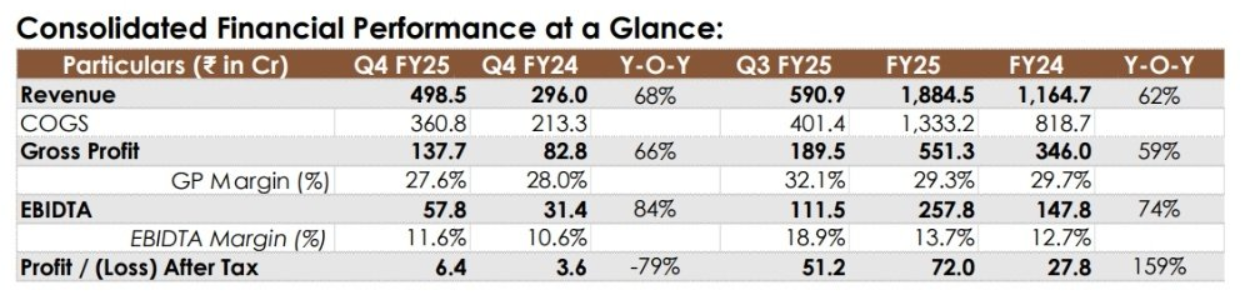

Key Financial Highlights (Quarter & Year Ended 31 March 2025)

Quarterly Performance (Q4 FY25 vs Q4 FY24)

- Revenue from Operations:

- Q4 FY25: ₹49,851 lakh

- Q4 FY24: ₹29,603 lakh

- Growth: Up 68% year-on-year, showing strong sales momentum.

- Total Income:

- Q4 FY25: ₹49,983 lakh

- Q4 FY24: ₹29,682 lakh

- Profit Before Tax (PBT):

- Q4 FY25: ₹1,048 lakh

- Q4 FY24: ₹33 lakh

- Growth: Major improvement, indicating a turnaround in profitability.

- Net Profit (PAT):

- Q4 FY25: ₹667 lakh

- Q4 FY24: ₹387 lakh

- Growth: Net profit nearly doubled year-on-year.

- Earnings Per Share (EPS):

- Q4 FY25: ₹1.93

- Q4 FY24: ₹1.12

Full Year Performance (FY25 vs FY24)

- Revenue from Operations:

- FY25: ₹1,88,449 lakh

- FY24: ₹1,16,472 lakh

- Growth: Up 62% year-on-year, reflecting rapid expansion.

- Profit Before Tax (PBT):

- FY25: ₹9,671 lakh

- FY24: ₹3,058 lakh

- Growth: More than tripled, showing strong operational improvement.

- Net Profit (PAT):

- FY25: ₹7,090 lakh

- FY24: ₹2,728 lakh

- Growth: Up 160% year-on-year.

- EPS (Basic & Diluted):

- FY25: ₹20.50

- FY24: ₹7.89

Easy-to-Understand Insights

- Sales Surge: V2 Retail has delivered outstanding sales growth, both for the quarter and the full year, indicating strong consumer demand and successful store expansion.

- Profit Turnaround: The company has sharply improved its profitability, with net profits and earnings per share more than doubling year-on-year.

- Operational Efficiency: Despite higher costs (notably in stock-in-trade and employee expenses), V2 Retail has managed to grow profits, suggesting better cost control and improved scale.

- Balance Sheet Strength: The company’s equity base has grown, and it maintains a sizable paid-up equity share capital, supporting future expansion.

Future Prospects

Positives:

- Strong Growth Momentum: Continued expansion in sales and profits positions V2 Retail as a leading value retailer in India.

- Scalability: The company’s ability to grow revenues rapidly suggests its business model is scalable, with potential for further geographic and store network expansion.

- Consumer Tailwinds: Rising demand for affordable fashion and value retail in India supports future growth.

Risks/Challenges:

- Cost Pressures: Rising costs for inventory, employees, and finance may impact margins if not managed carefully.

- Competition: The value retail segment is highly competitive, with both organized and unorganized players.

- Valuation: Rapid share price gains and high earnings multiples could make the stock vulnerable to corrections if growth slows.

Should You Keep V2 Retail for the Long Term?

- If you already own the stock: The company’s strong financial turnaround, rapid growth, and improving profitability make it a compelling long-term hold, provided you monitor cost management and competitive dynamics.

- If considering a new investment: The fundamentals are strong, but be mindful of high valuations and keep an eye on future quarterly results for sustained performance.

Summary Table

| Metric | Q4 FY25 | Q4 FY24 | FY25 | FY24 |

|---|---|---|---|---|

| Revenue (₹ lakh) | 49,851 | 29,603 | 1,88,449 | 1,16,472 |

| Net Profit (₹ lakh) | 667 | 387 | 7,090 | 2,728 |

| EPS (₹) | 1.93 | 1.12 | 20.50 | 7.89 |

Conclusion: V2 Retail has delivered an impressive financial turnaround, with rapid sales growth, improving profitability, and strong operational metrics. The company is well-positioned to benefit from India’s value retail boom. However, its high stock valuation and rising debt are important risks to monitor. For long-term investors, V2 Retail can be a promising portfolio candidate if you are comfortable with higher risk and are willing to monitor execution and valuation closely. Conservative investors may consider waiting for a more attractive entry point or signs of sustained margin improvement before making a long-term commitment.

V2 Retail: Is It a Good or Risky Long-Term Investment?

Strengths for Long-Term Investment

- Strong Fundamentals: As of May 2025, V2 Retail’s fundamentals are considered strong, with consistent growth in revenue and profitability. The company’s quarterly and yearly earnings trends are upward, and there is no significant promoter share pledging, which signals management confidence and stability.

- Outstanding Stock Performance: The stock has delivered a remarkable 323.9% return over the past year, far outperforming sector peers such as Avenue Supermarts, Trent, and Metro Brands.

- Low Debt: The debt-to-equity ratio remains low (0.28 standalone, 0.33 consolidated as of March 2024), providing financial flexibility and reducing solvency risk.

- Profit Growth: Recent results show profit before tax up over 1,000% year-on-year and net sales up 68%, with net profit nearly doubling year-on-year. This reflects a robust business model and strong consumer demand.

Risks and Concerns

- High Valuation: The stock is currently expensive, trading at a P/E of 98.76 and a price-to-book (P/B) ratio of 24.88, which is significantly above its estimated intrinsic value (fair value estimated at ₹615.89 vs. market price of ₹1,975.80)1. This means the stock is trading at a 221% premium, making it vulnerable to corrections if growth slows or market sentiment shifts.

- Rising Interest Expenses: Interest costs have reached their highest in five quarters, indicating increased borrowings to fund expansion. This could impact future profitability if not managed carefully.

- Margin Pressure: While revenue and profit are growing, rising costs and competitive pricing could pressure margins in the future.

- Competitive Sector: The value retail segment is highly competitive, with both organized and unorganized players, which could affect future growth rates and profitability.

Summary Table: Key Metrics

| Metric | Value (May 2025) |

|---|---|

| 1-Year Return | 323.9% |

| P/E Ratio | 98.76 |

| P/B Ratio | 24.88 |

| Debt/Equity (Standalone) | 0.28 |

| Intrinsic Value Estimate | ₹615.89 |

| Market Price (EOD) | ₹1,975.80 |

| Promoter Pledge | 0% |

Conclusion: Good or Risky for Long-Term?

V2 Retail is fundamentally strong and has delivered exceptional returns, making it an attractive growth story for the long term. However, the current high valuation and rising interest expenses introduce notable risks.

- If you already hold the stock: It remains a solid long-term candidate, but consider booking partial profits or monitoring closely for any signs of slowing growth or margin compression.

- If considering a new investment: The stock appears overvalued at current levels, so waiting for a correction or more reasonable entry point may be prudent.

In summary: V2 Retail is a fundamentally sound company with strong growth prospects, but its high valuation and rising costs make it a higher-risk investment at present. Long-term investors should weigh these factors carefully before making portfolio decisions