Bajaj Healthcare Ltd: Q4 & FY25 Financial Results Explained

Bajaj Healthcare Ltd, a prominent player in India’s pharmaceutical sector, has recently released its financial results for the quarter and year ended March 31, 2025. After a challenging period marked by losses, the company has staged a notable turnaround—returning to profitability and delivering robust revenue growth. This analysis delves into the key highlights of Bajaj Healthcare’s latest financial performance, examines the underlying growth drivers, and evaluates the stock’s future prospects and suitability as a long-term investment in your portfolio.

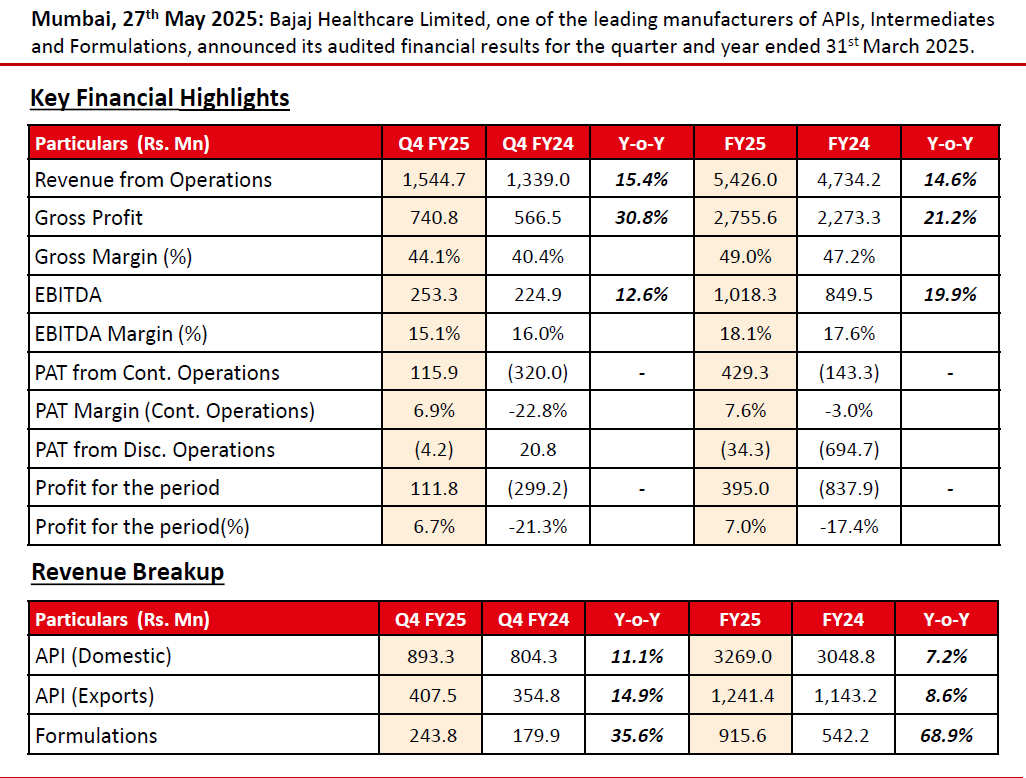

Key Financial Highlights (Q4 FY25 & FY25)

- Revenue Growth:

- Q4 FY25 revenue rose 15.4% YoY to ₹1,544.7 million.

- FY25 revenue grew 14.6% YoY to ₹5,426.0 million.

- Profitability:

- Gross profit increased 30.8% YoY in Q4, and 21.2% YoY for FY25.

- Gross margin improved to 44.1% in Q4 FY25 (from 40.4% last year) and 49.0% for FY25 (from 47.2%).

- EBITDA margin was steady at 15.1% in Q4 and improved to 18.1% for FY25 (from 17.6%).

- Net Profit:

- PAT from continuing operations turned positive: ₹115.9 million in Q4 FY25 (vs. a loss of ₹320 million last year).

- FY25 PAT from continuing operations was ₹429.3 million (vs. a loss of ₹143.3 million in FY24).

- Overall profit for the period was ₹111.8 million in Q4 (vs. a loss of ₹299.2 million last year), and ₹395.0 million for FY25 (vs. a loss of ₹837.9 million in FY24).

- PAT Margin:

- Q4 FY25: 6.7% (vs. -21.3% last year).

- FY25: 7.0% (vs. -17.4% last year).

Revenue Breakup

- API (Domestic):

- Q4 FY25: ₹893.3 million, up 11.1% YoY.

- FY25: ₹3,269.0 million, up 7.2% YoY.

- API (Exports):

- Q4 FY25: ₹407.5 million, up 14.9% YoY.

- FY25: ₹1,241.4 million, up 8.6% YoY.

- Formulations:

- Q4 FY25: ₹243.8 million, up 35.6% YoY.

- FY25: ₹915.6 million, up a robust 68.9% YoY.

Easy-to-Understand Insights

- Strong Recovery: Bajaj Healthcare has bounced back from losses last year to profitability this year, both at the quarterly and annual levels.

- Improved Margins: Both gross and EBITDA margins have improved, indicating better cost control and operational efficiency.

- Growth Drivers: Formulations segment is the fastest-growing, with nearly 69% growth for the year, while both domestic and export API businesses are also expanding steadily.

- Profit Turnaround: The company has moved from negative to positive profit margins, reflecting a significant turnaround in its financial health.

Future Prospects & Long-Term View

Positives

- Sustained Revenue & Profit Growth: Consistent double-digit growth in revenues and a strong turnaround in profitability are good signs for the company’s future.

- Margin Expansion: Improved margins suggest the company is managing costs well and possibly moving up the value chain, especially in formulations.

- Diversified Revenue Streams: Balanced growth in both APIs (domestic and exports) and formulations reduces dependence on a single segment.

Risks/Watch Points

- Sustainability: The company needs to maintain this growth momentum and margin improvement, especially in a competitive pharma environment.

- Industry Factors: Regulatory changes, pricing pressures, and raw material costs could impact future performance.

Should You Hold for the Long Term?

- If you already own the stock: The turnaround in profitability, improving margins, and robust growth—especially in the high-margin formulations segment—make Bajaj Healthcare a candidate for long-term holding, provided the company continues to execute well and sector conditions remain stable.

- For new investors: Consider monitoring for a couple more quarters to ensure the turnaround is sustained, but the improving fundamentals are promising.

Bajaj Healthcare: Is It a Good or Risky Long-Term Investment?

Why Bajaj Healthcare Might Be a Good Long-Term Investment

- Turnaround Potential: The company has recently returned to profitability after posting losses in the previous year, with improved revenues and margins in FY25. This turnaround suggests management is effectively addressing past challenges and adapting to market conditions.

- Margin Improvement: Gross and EBITDA margins have improved, indicating better operational efficiency and cost control. This is a positive sign for sustainable profitability going forward.

- Growth in Key Segments: The formulations segment, in particular, has shown robust growth (nearly 69% YoY), and both domestic and export API sales are rising. Diversification across products and geographies reduces risk and supports future growth.

- Industry Tailwinds: The pharmaceutical sector in India is expected to grow at a healthy pace, driven by rising healthcare spending, export opportunities, and ongoing demand for generics and specialty drugs.

- Reasonable Debt Levels: The company maintains a moderate debt-to-equity ratio (0.48), which suggests manageable financial leverage and less risk from interest costs1.

- Book Value and Asset Base: With a book value of ₹141.16 and a price-to-book ratio of 4.27, the company is not excessively overvalued relative to its assets1.

Why Bajaj Healthcare Might Be Risky for Long-Term Holding

- Volatile Earnings History: The company’s profit and loss record over the last several years has been inconsistent, with swings from profit to loss (notably a large loss in FY24, and only recently returning to profit in FY25)3. Such volatility can make long-term forecasting and valuation difficult.

- High Valuation Metrics: The trailing P/E ratio is extremely high (or negative due to recent losses), making it hard to justify the current price based on earnings1. This suggests the stock is priced for strong future growth, which may not materialize.

- Low Analyst Coverage & Uncertain Forecasts: There is a lack of analyst coverage and reliable future earnings/revenue forecasts for Bajaj Healthcare, making it harder for investors to gauge the company’s future prospects and compare it to peers2.

- Sector and Regulatory Risks: The pharmaceutical industry faces regulatory scrutiny, pricing pressures, and risks from changing government policies, all of which can impact margins and growth.

- Dividend Yield Is Low: The dividend yield is just 0.15%, so investors seeking regular income may find better options elsewhere1.

Summary Table: Pros and Cons

| Reasons to Hold Long-Term | Risks/Concerns |

|---|---|

| Recent return to profitability | Volatile earnings and profit history |

| Improving margins and operational metrics | High/negative P/E, valuation concerns |

| Growth in formulations and APIs | Low analyst coverage, few forecasts2 |

| Moderate debt levels | Regulatory and sector risks |

| Industry growth tailwinds | Low dividend yield |

Conclusion: Keep or Not for Long Term?

Bajaj Healthcare shows promise as a turnaround story, with improving financials, margin expansion, and growth in key business segments. However, its volatile earnings history, high valuation, and lack of analyst coverage make it a higher-risk investment compared to more established pharma peers.- If you have a high risk tolerance and believe in the company’s turnaround and sector growth, it could be a speculative long-term hold.

- If you prefer steady, predictable growth and lower volatility, you may want to monitor the company for a few more quarters or consider more established alternatives in the sector.