GMM Pfaudler OFS Analysis

GMM Pfaudler’s OFS is now open for retail investors. The floor price for the OFS is fixed at ₹3,500, a steep 25% discount to yesterday's close price of ₹4,717. We have prepared a short analysis of the OFS (Offer for Sale).

GMM Pfaudler Offer for Sale (OFS) Analysis

About GMM Pfaudler Offer for Sale

- GMM Pfaudler’s OFS is now open for retail investors. The floor price for the OFS is fixed at ₹3,500, a steep 25% discount to yesterday's closing price of ₹4,717.

- Pfaudler Inc (the parent) and Urmi Patel are selling 25.71 lakh shares or 17.59% of the total equity with an option to sell an additional 15.22 lakh shares (10.41%)

- In an OFS, promoters of a company sell their shares on an exchange platform, generally at a discount to the current market price.

About GMM Pfaudler

The company was founded in 1962 as Gujarat Machinery Manufacturers. In 1987, Pfaudler Inc., a world leader in process equipment and solutions for the chemicals and pharmaceuticals industry picked up a 40% stake in the company. By 1999, the stake had risen to over 50%, and GMM Pfaudler became a subsidiary of Pfaudler Inc.

Background and Need for OFS

- The OFS is part of a larger transaction, where the promoters along with the Indian subsidiary (GMM Pfaudler) are looking to buy a majority stake (54%) in the parent company Pfaudler Inc.

- The acquisition is proposed to be done through GMM International, a new company to be set up in Luxemburg.

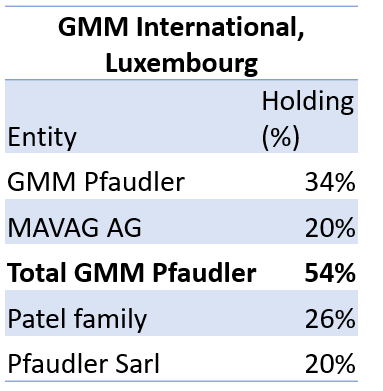

- The Indian subsidiary GMM Pfaudler (34.4% directly and 19.6% through its wholly subsidiary Mavag AG) and the Patel family will acquire a 54% and 26% equity stake respectively in the Pfaudler International Group. The table below shows the final proposed holding in GMM International after the transactions.

- The entire transaction is happening without any equity dilution.

Journey Till Date

- Shares of GMM Pfaudler, the world’s largest producer of glass-lined reactors for pharmaceutical and chemical industries, has seen a volatile movement in the past 6 months, reaching a 52 week-high of ₹6,913 early last month.

- The OFS is at approx. 50% discount to the 52 weeks high, and a 25% discount to Tuesday’s close.

- GMM Pfaudler shares have soared as the company has just 25% of free-float. The remaining is held by the promoters.

- While it is appropriate to judge the sanctity of such a rally in stock with very high promoter holding and low floating stock, a sound decision will be based on both the history and future prospects of the company.

Analysis

GMM Pfaudler is eyeing to be the leader in the industry worldwide and the consolidation of Pfaudler will help gain that market share. While we can expect the share price to remain volatile in the next few days, the OFS sure offers investors a piece into the new leader in this space as and when the consolidation happens.

The valuations remain stretched (PE of 108 times). The company’s revenues have grown by about 11% annually in the last 10 years, and profits have grown at a CAGR of about 23% in the last 10 years. The company remains a quality business.